Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

Medicare assistance is our specialty. We offer our policyholders a complimentary service that provides ongoing support with their Medicare needs for the duration of their policy at no cost to you. This service connects you with a team of Medicare experts dedicated to answering questions and resolving nearly all Medicare-related issues. Our Client Service Team will act as your advocate, ensuring you never have to contact Medicare or the insurance carrier on your own.

1. Find Medicare Plans Designed for Your Needs

At McDonald Group Insurance Services we evaluate Medicare plans based on your specific needs to identify options that are best suited for you. We compare factors such as premium costs, doctors, medications, dental, vision, and more. By sharing your details with us, we can narrow down your choices and present plans that align with your needs. We’ll review multiple options with you, allowing you to choose the plan that you feel is the best fit.

2. We Keep Our Policyholders Informed About Rules & Regulations That May Affect You

Medicare rules and regulations are updated each year, at McDonald Insurance Group Services, we stay up-to-date on the latest changes so you don’t have to. We know it can be overwhelming, and we’re here to help with any questions you may have.

3. We Will Ensure You Only Pay Bills That Are Your Responsibility

Medical bills often involve multiple parties, which can sometimes lead to mistakes in processing. Additionally, your Medicare status can change—whether Medicare becomes your primary insurance or you switch supplement plans—and it may take some time for everyone involved to update their records.

It’s not uncommon to receive a bill that you expected Medicare to cover. Figuring out whether you owe the bill or if there’s been an error can be confusing. But don’t worry! If your policy is with McDonald Insurance Group Services, you can send any questionable bills our way. Our Client Service Team will investigate the issue and follow up with you.

If the bill is accurate, you’ll need to pay it. If not, we’ll resubmit it to the proper party for correction.

4. We Will Handle Claim Resubmissions on Your Behalf

The bills referenced above are classified as claims. If we find that a claim was issued in error, we will reach out to the responsible party for payment and follow up to ensure the issue is resolved.

This process saves you hours of effort spent contacting the right parties to get your Medicare claims paid.

5. We Can Help You Appeal If Your Application Is Declined by a Carrier

We understand how frustrating it can be if your application is declined by a carrier. If this happens, we're here to guide you through the appeal process every step of the way. We’ll help you understand the reason behind the denial and work with you to gather the necessary documentation to address any issues. Our team will communicate directly with the carrier on your behalf, ensuring that your case is properly reviewed and reconsidered. We’ll be by your side throughout the entire process, advocating for your best interests to increase the likelihood of a favorable outcome. Our goal is to ensure you get the coverage you deserve, and we’ll make sure your appeal is handled efficiently and professionally.

At McDonald Insurance Group, we are committed to making your Medicare experience as smooth and stress-free as possible. Our Client Service Team is here to provide ongoing support, offering personalized assistance, expert advice, and advocacy throughout the entire process. From helping you choose the right plan to resolving billing issues and managing claims, we’re with you every step of the way. No matter what challenges arise, you can count on us to ensure you receive the care and support you deserve. Let us handle the complexities of Medicare, so you can focus on what matters most—your health and well-being.

Mar 28, 2025

What is Medicare Supplemental Insurance?

Medigap, also known as Medicare Supplemental Insurance, is a private insurance policy that helps cover the out-of-pocket costs that Original Medicare (Parts A and B) doesn't fully pay, such as deductibles, copayments, and coinsurance. Here’s what you need to

Mar 22, 2025

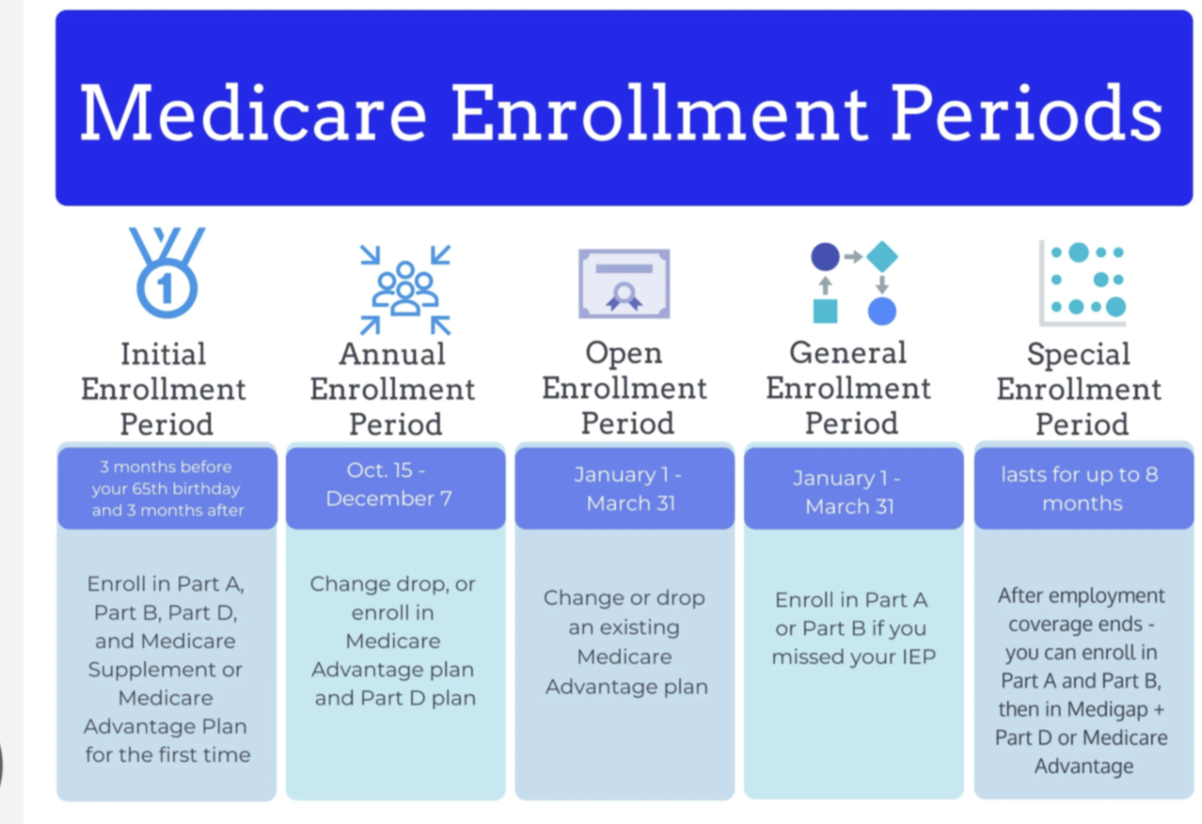

Medicare/Health insurance enrollment explained: OEP, IEP, AEP & more. Learn when to enroll, avoid penalties, & get the right plan. Expert guidance available.

Mar 18, 2025

Expert Medicare help: plan selection, rule updates, bill disputes, claim resubmissions, & appeals. We advocate for you, ensuring stress-free coverage.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.