Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

As a life insurance broker, I understand navigating the different types of coverage can feel overwhelming. But fear not! This blog is your one-stop shop for understanding the core life insurance options available.

Imagine a shield protecting your loved ones for a specific period. That's term life insurance in a nutshell. It provides a death benefit – a payout to your beneficiaries – if you pass away within a set term, like 10, 20, or 30 years. Term life is typically the most affordable option, making it ideal for young families or those on a budget who need coverage for specific financial obligations like a mortgage. However, be aware that the policy terminates after the term ends, and you won't get any money back unless you have a rider (an add-on feature) attached.

Permanent life insurance, as the name suggests, stays in effect your entire life – as long as you keep paying premiums. It offers not only a death benefit but also builds cash value over time. This cash value acts like a mini-savings account, accumulating interest and potentially accessed through loans or withdrawals (depending on the policy).

Life insurance extends beyond these core types. Here are some additional options to consider:

There's no one-size-fits-all answer when it comes to life insurance. The best policy depends on your individual needs, budget, and future goals. Consulting with a life insurance broker like myself can help you navigate your options, assess your needs, and find the coverage that provides peace of mind for you and your loved ones.

Remember, this blog is just a starting point. Feel free to reach out with any questions you may have – I'm here to help you make informed decisions about your life insurance journey.

Mar 28, 2025

What is Medicare Supplemental Insurance?

Medigap, also known as Medicare Supplemental Insurance, is a private insurance policy that helps cover the out-of-pocket costs that Original Medicare (Parts A and B) doesn't fully pay, such as deductibles, copayments, and coinsurance. Here’s what you need to

Mar 22, 2025

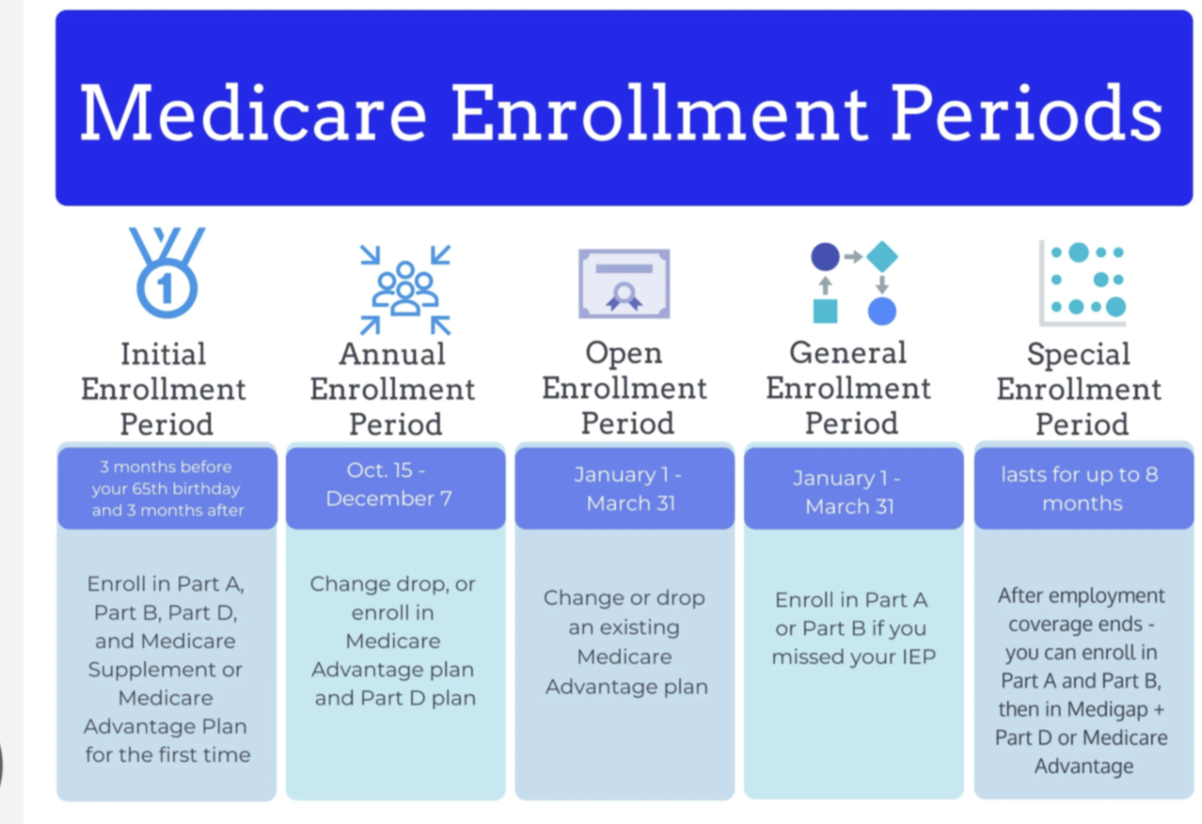

Medicare/Health insurance enrollment explained: OEP, IEP, AEP & more. Learn when to enroll, avoid penalties, & get the right plan. Expert guidance available.

Mar 18, 2025

Expert Medicare help: plan selection, rule updates, bill disputes, claim resubmissions, & appeals. We advocate for you, ensuring stress-free coverage.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.