Speak with an Expert Today!

229-457-6943

Speak with an Expert Today!

229-457-6943

Turning 65 and eligible for Medicare? You might be feeling overwhelmed by all the options. One of the biggest decisions you'll make is between staying on Original Medicare and joining a Medicare Advantage Plan. This blog will break down the key differences to help you pick the plan that best fits your needs.

| Feature | Original Medicare | Medicare Advantage Plans |

|---|---|---|

| Who Runs It | Federal Government | Private Insurance Companies |

| Parts Covered | A & B (you may need a separate Part D plan for drugs) | A & B (usually includes Part D) |

| Extra Benefits | Limited | May include vision, hearing, dental, and more |

| Doctor Choice | Any doctor or hospital accepting Medicare | Network of approved providers |

| Out-of-Pocket Costs | Part A deductible, Part B premium & deductible, and additional costs for some services | May have copays, deductibles, and out-of-pocket maximums |

Remember: You can always switch between Original Medicare and a Medicare Advantage Plan during the annual Open Enrollment Period (October 15 - December 7).

This blog provides a starting point, but it's important to consult with a licensed insurance broker like me to understand the specifics of each plan and how it fits your individual needs and budget. They can answer your questions and help you choose the best option for you.

Mar 28, 2025

What is Medicare Supplemental Insurance?

Medigap, also known as Medicare Supplemental Insurance, is a private insurance policy that helps cover the out-of-pocket costs that Original Medicare (Parts A and B) doesn't fully pay, such as deductibles, copayments, and coinsurance. Here’s what you need to

Mar 22, 2025

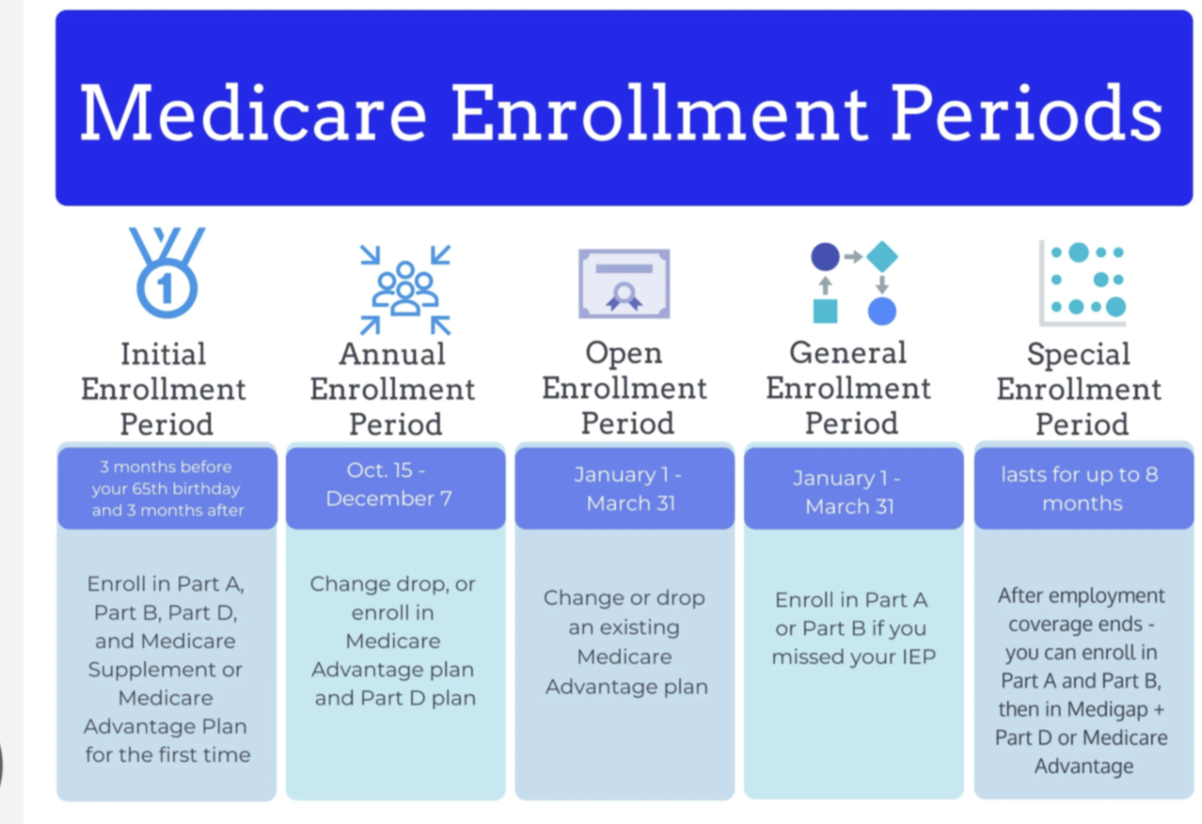

Medicare/Health insurance enrollment explained: OEP, IEP, AEP & more. Learn when to enroll, avoid penalties, & get the right plan. Expert guidance available.

Mar 18, 2025

Expert Medicare help: plan selection, rule updates, bill disputes, claim resubmissions, & appeals. We advocate for you, ensuring stress-free coverage.

Licensed Insurance Agency

Not connected with or endorsed by the United States government or the federal Medicare program.

We do not offer every plan available in your area. Any information we provide is limited to those plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program.